🛻Second Car Loan EMI Calculator

India is now the world’s fourth-largest market for four-wheelers, with a consistent growth rate of 9.5% year-on-year. Naturally, the demand for a reliable and user-friendly car loan EMI calculator has surged alongside this growth.

The Car Loan EMI Calculator is a simple online tool that helps you calculate the EMI you need to pay for your Car Loan. By providing basic information about your loan, such as the loan amount, tenure, and interest rate, you can quickly calculate your monthly EMI.

🚙 Who Should Use This Calculator?

- Pre-Owned Car Buyers: Individuals planning to purchase a second-hand or used car with the help of a loan.

- Existing Borrowers: Those already paying a used car loan and wanting to check refinancing or prepayment options.

- Budget-Conscious Buyers: People comparing different loan amounts, interest rates, and tenures to find an affordable EMI.

- Financial Planners & Advisors: Professionals assisting clients in evaluating used car financing.

✅ Why Use a Used Car Loan EMI Calculator?

- Quickly calculates the monthly EMI for a second-hand car loan.

- Helps you compare loan offers from banks, NBFCs, or dealers.

- Ensures better budget planning by showing total interest and repayment burden.

- Provides clarity on the true cost of buying a pre-owned car through financing.

How to Use the Car Loan EMI Calculator?

- Choose the amount that you need for your car

- Enter the interest rate offered to you

- Select a convenient loan tenure

- Press the ‘Calculate EMI’ button.

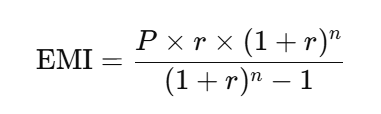

🧮Formula

Here, P, R, and N are the key variables. This means the EMI amount will vary each time you adjust any of these three. Let’s understand them in detail:

- P refers to the Principal Amount — the original loan amount provided by the bank, on which the interest is calculated.

- R stands for the Rate of Interest determined by the bank.

- N represents the Number of Years allotted for loan repayment. Since EMIs are paid monthly, the tenure is converted into the number of months.

For Example: Arvind has bought a second hand car worth 10 lakhs and he had taken a car loan of Rs 8 lakh at an interest rate of 12%, for period of 2 years

the approximate EMI will be:

- P = Rs 8,00,000

- R = 12 ÷ 12 ÷ 100 = 0.01 (or 1%)

- N = 3 years

- EMI = Rs 26,571.45

FAQs

1. What is a Used Car Loan EMI Calculator?

A. It’s a tool that helps you calculate the monthly installment (EMI) you need to pay when taking a loan to buy a second-hand or pre-owned car.

2. How is EMI for a used car loan calculated?

A. EMI is calculated based on three main factors – the loan amount, interest rate, and loan tenure. The calculator uses these inputs to give you an exact monthly repayment amount.

3. Is the EMI for a used car loan higher than for a new car loan?

A. Yes, usually. Since used car loans often come with slightly higher interest rates and shorter repayment terms, the EMI can be higher compared to new car loans.

4. Why should I use this calculator before applying for a loan?

A: It helps you plan your budget, compare different loan offers, and avoid financial strain by knowing your repayment obligations in advance.